How invoices are composed

This documentation, including images, videos and text, is accurate as of Version 6.0 of Pascal.

We strive to keep our documentation up to date with each release to ensure it remains a reliable resource for our users. However, given the dynamic nature of our software development, there might be instances where changes introduced in subsequent versions are not immediately reflected in this documentation. We encourage users to refer to the latest release notes and to use the feedback mechanism for any discrepancies or requests for clarification.

Invoices are applicable for Pascal organisations using the application in the Pay-as-you-go system.

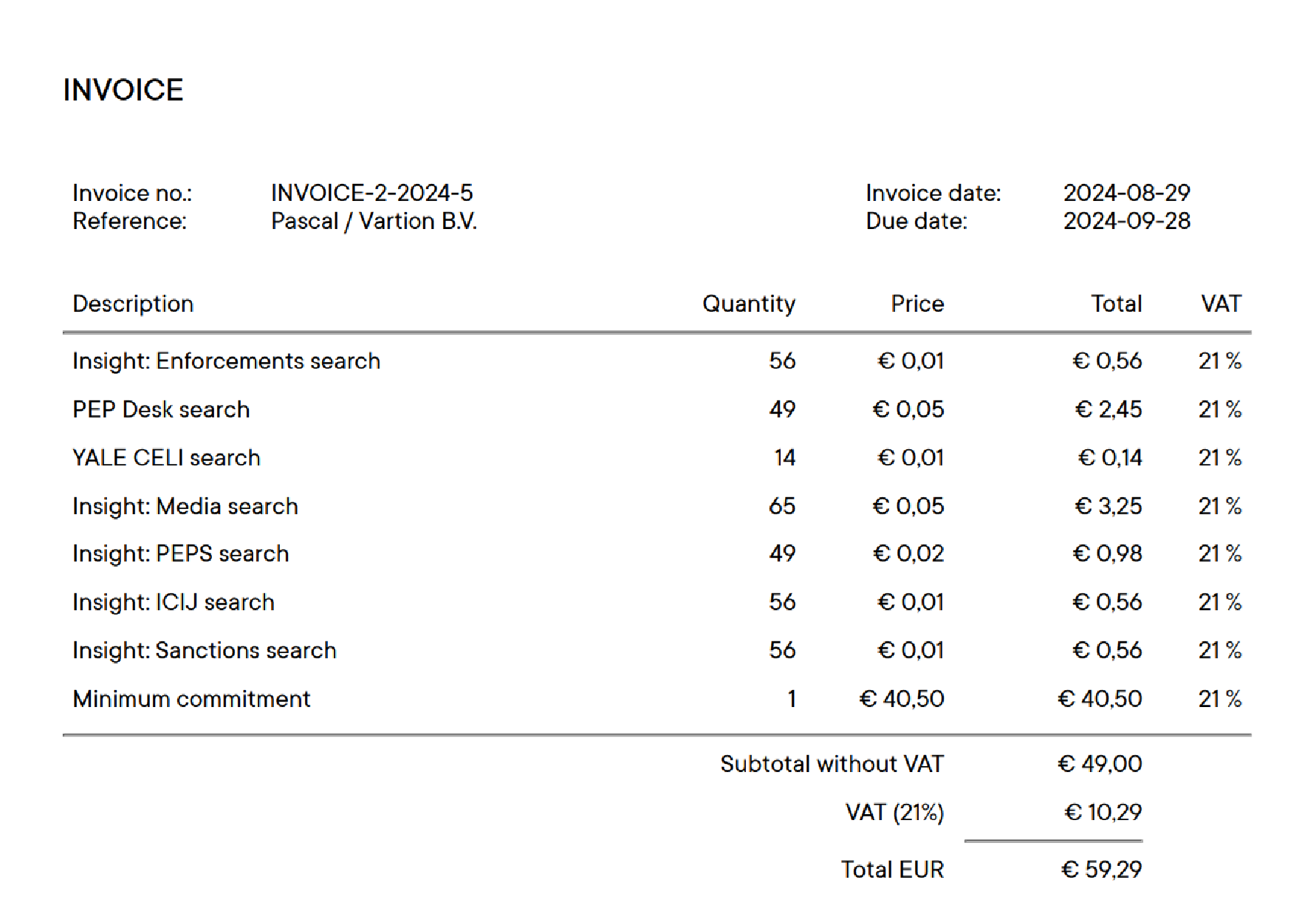

In Pascal, the billing period runs from the start of the month to the end of the month. You can change the date you receive the invoice, in the Billing details of the Billing Settings.

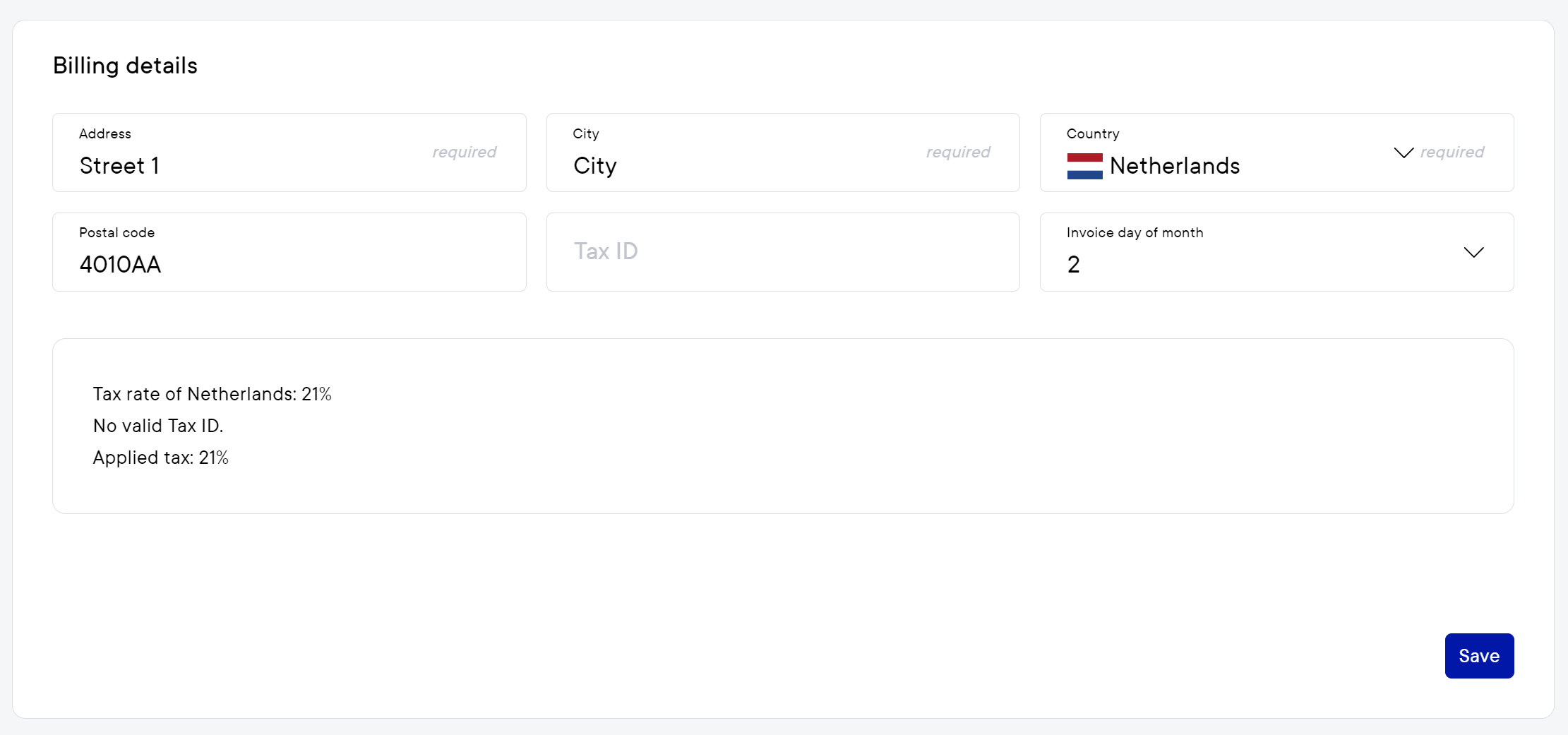

The invoice is send to the recipients mentioned in the Send emails to setting in the Notifications section of the Billing Settings. Invoices can also always be redownloaded via the Invoices section of the Billing Settings.

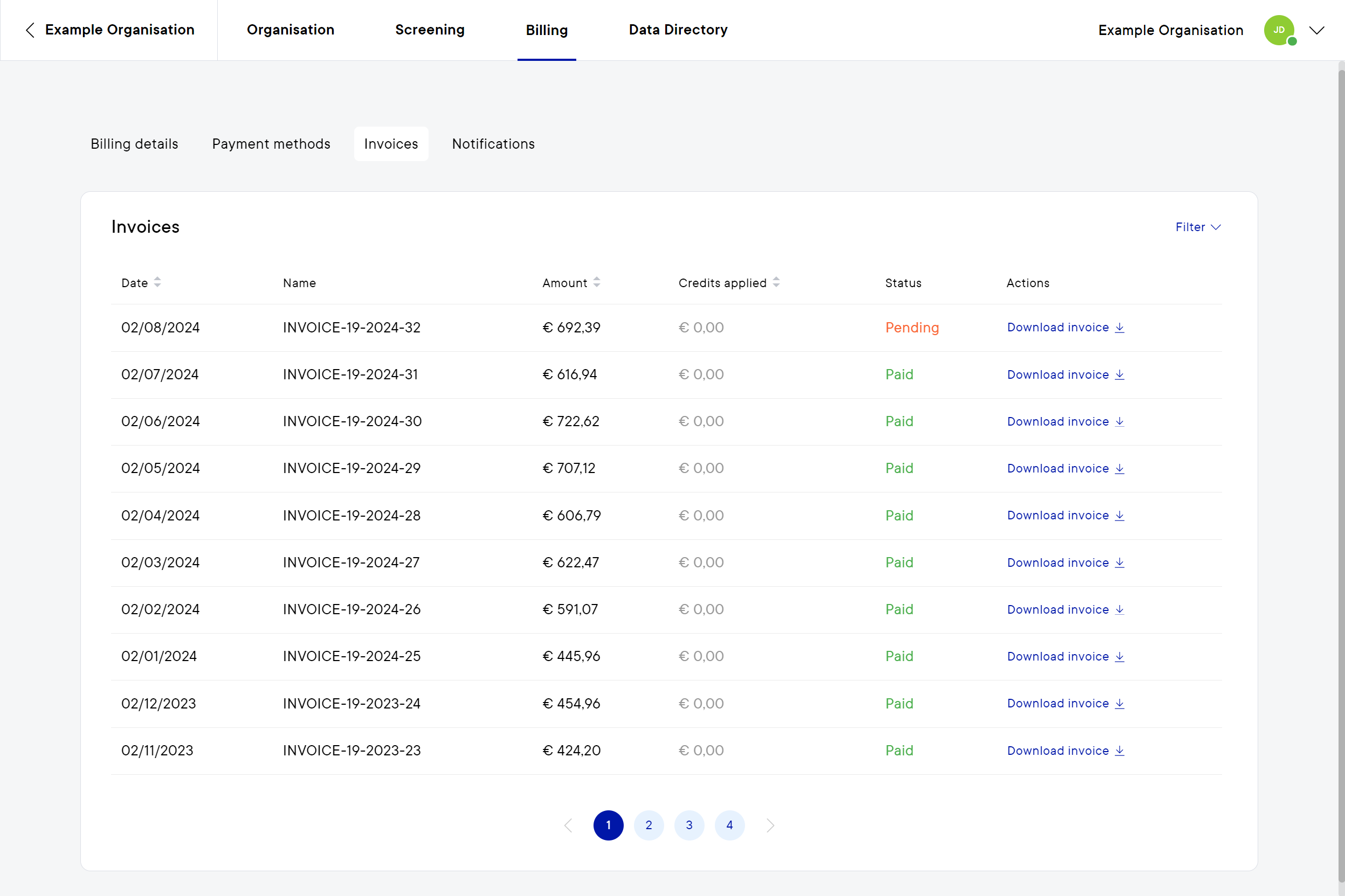

The invoice shows information regarding the billed month. At the top of the invoice, the invoice number, reference invoice date and due date for the payment are displayed. Below details of the billed month are provided, including the type of searches performed, the amount of those searches, the price for a single search of that type, the price of all the searches of a specific type and whether or not VAT is applied to your invoice.

Pascal has a minimum commitment of €49 per invoice. In the example above, the usage in the billing period does not exceed this minimum commitment threshold. Thus the remaining amount of €40,50 is added for the total of €49.

Whether or not VAT is applied to your invoice. depends on your country and Tax ID filled in the Billing details which can be found in the Billing Settings. Taxes are applied when the country is inside of the European Union and no valid Tax ID is submitted in the Billing details. Taxes are also applied when the country is Netherlands, regardless of a valid filled in Tax ID. We do not handle taxes outside of the EU, so regardless of a submitted Tax ID, the tax rate will be 0% for countries outside of the EU.